Junior Achievement USA® (JA) and The Allstate Foundation’s 2013 Teens and Personal Finance Poll shows that teenagers are more optimistic about their financial futures, with a 20 percent increase in teens believing they will be financially better off than their parents. However, part of their financial security comes from depending on parents until a later age.

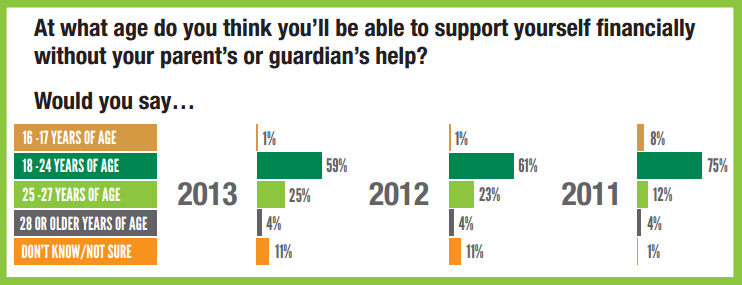

Nationally, the Allstate survey found that 25 percent of teens think they will be age 25-27 before becoming financially independent from their parents, up from 12 percent in 2011. In a similar survey conducted among Denver teens who had participated in a Junior Achievement program, only 9.6 percent said they will be age 25 or older before becoming financially independent from their parents.

“The survey results illustrate what we have known all along: JA students are better prepared to build a solid future for themselves,” said Chris Harr, board chair for Junior Achievement-Rocky Mountain, Inc. “Local JA parents, teachers and volunteers should be proud of the fact that 67 percent of surveyed Denver-area JA teens feel confident in their ability to budget and 80 percent are sure that they are successfully saving their money.”

The differences between Denver-area JA students and teens surveyed nationally are not only evident in questions related to ability, but also in attitude. Nationally, of the 33 percent of teens who say they do not use a budget, 42 percent are “not interested” and more than a quarter (26 percent) think “budgets are for adults.” Among the 19 percent of surveyed Denver-area JA teens who say they do not use a budget, only 13 percent say they are not interested in budgeting and less than 4 percent believe that “budgets are for adults.”

“JA programs will be presented to 107,000 local students this school year; however, there are also many steps Colorado parents can take to help today’s teens secure independent financial futures,” said Robin Wise, president and CEO of Junior Achievement-Rocky Mountain, Inc. “Parents continue to be the No.1 influence on teens when it comes to money. One goal many teens have is to go to college, yet nearly 30 percent of U.S. teens say they haven’t discussed paying for higher education with their parents and only nine percent admit to saving for college. There is a tremendous opportunity for family conversation on this topic.”

Other key findings from the national survey include:

- More than half of U.S. teens (52 percent) think students are borrowing too much to pay for college, yet only nine percent report they are currently saving money for college. Nearly 30 percent have not talked with their parents about paying for higher education.

- The majority of U.S. teens (76 percent) still report the best time to learn about money management is in kindergarten through high school, but only 29 percent reported programs currently in place.

Methodology

The national study was conducted Feb. 5-15, 2013, using the KnowledgePanel to interview 1,025 teens ages 14-18 years old. The survey’s margin of error is +/- 3 percent at the 95 percent confidence level.

The local survey was conducted online from January 23 through March 19, 2013.