According to a 2019 report by the Federal Reserve, 22% of American adults are either unbanked or underbanked.

This means that more than 56 million adults in the U.S. lack a safe space to save money, and consistently lose money to costly interest rates and fees from banking alternatives like check cashers and payday lenders.

A bank account protects and insures funds against disaster, keeps money organized and safe, allows for better management of saving and saving habits, and can even allow your account to earn interest; in short, banking is key to building wealth. But for many, setting up a bank account simply feels out of reach.

Who Are the Unbanked and Underbanked?

In the U.S. economic system, traditional banking is not necessarily available or accessible to all. Although the majority of American adults have a bank account and rely on traditional banks or credit unions to meet their banking needs, gaps in banking access remain. Tens of millions either lack a bank account entirely, or rely on potentially harmful financial services to manage their money.

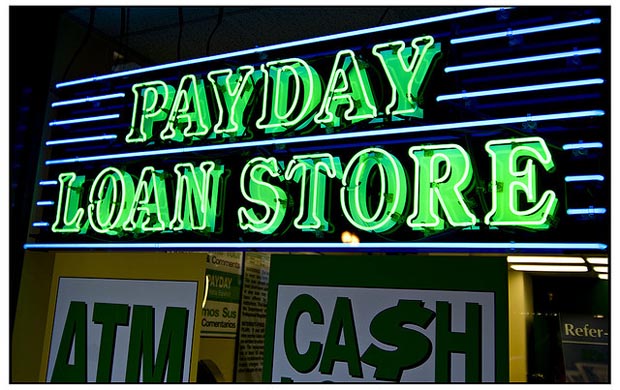

Some of these services include money orders, check cashing services, pawn shop loans, auto title loans, payday loans, paycheck advances, and tax refund advances to manage their finances and obtain emergency funds.

The unbanked and underbanked are more likely to be in lower income tiers, have less formal education, and/or be in a racial or ethnic minority group. In fact, 99% of unbanked individuals make less than $40,000/year, and 14% of Black Americans and 11% of Hispanic Americans are unbanked, compared to only 4% of white Americans.

Unbanked and underbanked populations may also lack access to a bank, and either have difficulty accessing a physical bank branch to set up and manage their account, lack the availability to visit a bank during open hours, or have limited internet access, impeding their ability to bank online.

Why Does Banking Matter?

According to the FDIC National Survey of Unbanked and Underbanked Households, most unbanked households in America believe they cannot afford to maintain a bank account, due to minimum balance requirements, overdraft fees, ATM fees, and maintenance fees. Additionally, many unbanked households simply don’t trust banks to properly manage their funds.

“Being outside of the banking system can leave people vulnerable,” says Nubia Martinez-Caro, Client Service Manager at Wells Fargo Bank.

“Access to tools and services to manage our personal finances–from making transactions, building emergency savings to accessing short-term credit–is the foundation of growing financially healthy and resilient communities and ultimately, building wealth.”

With high interest rates and fees, alternative financial services like payday loans and check cashers may promise quick cash to those who need it, but at a significant cost.

This puts an already vulnerable population in a further disadvantaged position that can lead to a cycle of debt for several reasons:

- With high interest rates and fees, the costs for alternative financial services are often far higher than they appear.

- Alternative financial services (such as payday loans) can often result in a debt trap, in which borrowers continually take out new loans to pay back previous loans. Getting trapped in debt is not only costly, but can also negatively affect credit history. (Lack of access to credit and credit history is, in turn, an obstacle when making wealth-building investments.)

- Lacking a bank account makes it difficult to build an emergency fund, or any meaningful savings over time.

Bank accounts are key to managing fees and expenses associated with banking, and accumulating emergency funds and long-term wealth.

How Do We Break the Cycle?

Building financial security involves aggregating resources, capabilities, and institutional support that enable families and individuals to not only sustain themselves, but also give them the opportunity to move up the economic ladder.

At JA Rocky Mountain, we know that creating a future where our children can participate and thrive in the economy starts both at home and in school.

We offer financial education programs that put students on the road to career success and prosperity. Our curriculum helps them acquire the skills to understand and create savings plans and budgets, establish long-term goals, and navigate choices among financial products and services.

“Financial literacy is a key component to financial success,” says Martinez-Caro. “Teaching financial literacy to our youth can help overcome the challenges of underbanked communities because they are often a fountain of information for their families. By teaching them financial literacy, we are not only impacting their generation, but the generations before them and after them. We can all benefit from being smarter about money.”

When students know why and how to access financial products and services that are critical to building a secure future (such as savings, funds for a college education, stocks and bond investments, home mortgages, business loans, and retirement accounts), then they can make choices that positively impact their financial well-being.

Our programs give our youth the key to open the door to tools and resources to leave poverty behind, achieve economic security, and access a better future to reach their full potential. Want to make a difference in the life of youth in your community? Learn more about our purpose, our programs and how to get involved.